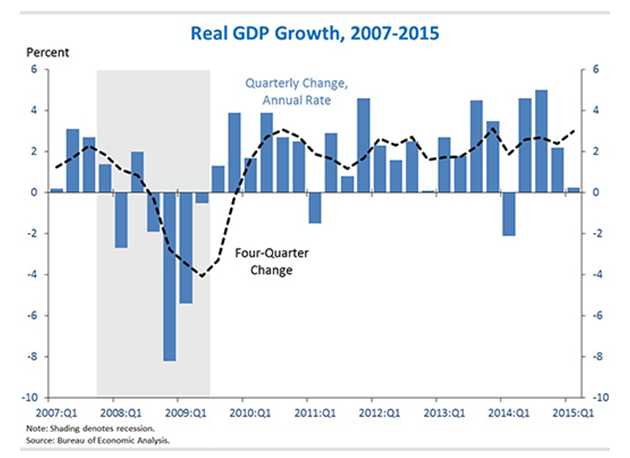

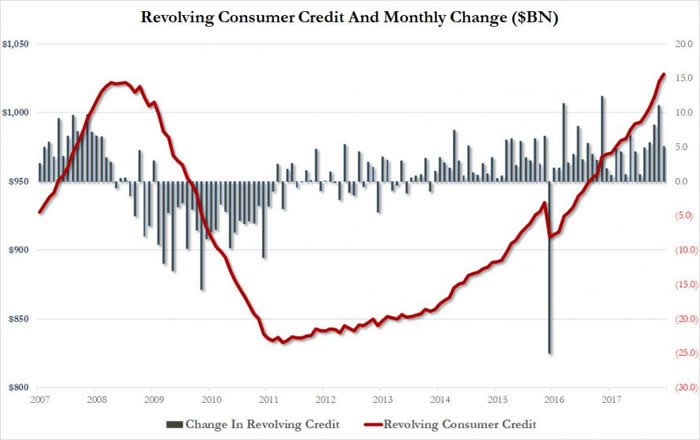

Neither is likely to upset the consensus view: The economy is stuck in an endless loop of about 2% annual growth or less, well below the nation’s historic 3.3% average. Key reports such as retail sales and consumer inflation are for March, the final month of the first quarter. Manufacturers appear to have gotten a shot in the arm, as exports rose in February for the first time since last fall.Ī large batch of economic data this week won’t tell us much about the second quarter, however. That’s given the economy a boost heading into the second quarter by pushing stock prices up and interest rates down, while causing the dollar to ease 5% off multiyear highs. interest rates this year.Īlso read: New York Fed’s Dudley calls for cautious approach to lifting interest rates Middling growth at home and an especially a sour global outlook has generated enough anxiety at the Federal Reserve to spur the bank to temporarily put off plans to sharply increase U.S. A strong dollar has curbed sales of American exports, and a global plunge in oil prices has dulled a domestic energy industry that had been one of the economy’s brightest stars. Most of the rest of the world is far worse off economically compared to the U.S. Nor can businesses look outside the country to shore up growth and profits. “In many ways the labor market recovery remains subdued, with some visible chinks in the armor beginning to show,” said Scott Anderson, chief economist of Bank of the West. There’s been a notable shift in recent months to new jobs in fields such as retail and hospitality that pay less and offer workers fewer hours.

#The us has a goldilocks economy cracked

That could mean either less investment or fewer new hires, neither of which would be good for long-term growth.Įven the steady gains in job creation, at least lately, are arguably not all they are cracked up to be. If profits fail to recover, it’s only a matter of time before companies move to cut more costs. Earnings sank 3.2% in 2015 to mark the first decline since the Great Recession, government figures show. What’s going on? By some measures the economy is weaker now entering the spring than it was in the past two years.īusinesses, for example, has cut back on investment as profits have fallen. Read: Why poor first-quarter GDP is nothing to worry about Weak first quarters in 20, by contrast, were followed by much larger increases of 4.6% and 3.9% in the ensuing second quarters. That’s why economists polled by MarketWatch predict gross domestic product will pick up in the spring and grow about 2.5% in the second quarter.ĭecent, not great. Stock markets are back up, interest rates are back down and gas is still pretty cheap despite recent price increases. Businesses have whittled down excess inventories that were a drag on the economy.

Home builders are hard at work as more Americans look to buy.

Companies are still hiring plenty of new workers and all the extra cash has helped to boost consumer spending, the lifeblood of the economy. The same pattern is likely to reemerge this year, but this time the green shoots might not be as vigorous. economy has been marked by barren first quarters following by blossoming growth in the spring. Growth likely to pick in spring, but economy still not ‘just right’

0 kommentar(er)

0 kommentar(er)